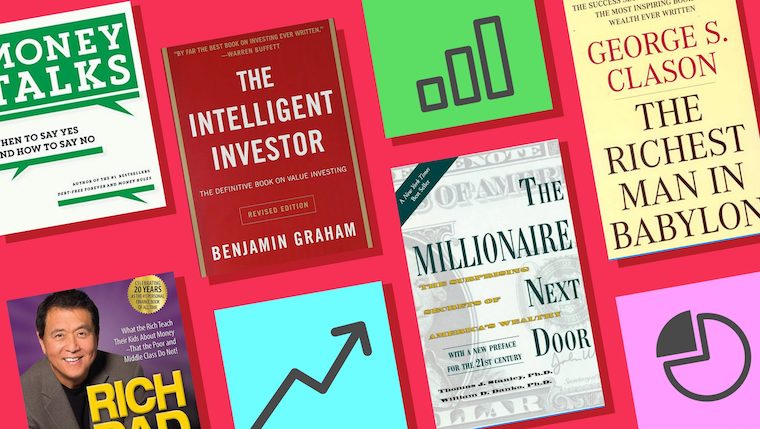

In personal finance, individuals seek reliable guidance to navigate the complexities of managing money, investing wisely, and achieving financial independence. Fortunately, a treasure trove of knowledge is available in the form of personal finance books.

From timeless classics to contemporary bestsellers, these books offer invaluable insights, strategies, and practical tips to empower readers on their journey toward financial success. In this article, we’ll explore some of the best personal finance books that have stood the test of time and continue to shape the financial destinies of countless individuals.

“Rich Dad Poor Dad” by Robert Kiyosaki

No list of personal finance books is complete without mentioning Robert Kiyosaki‘s groundbreaking work, “Rich Dad Poor Dad.” This classic challenges conventional beliefs about money and introduces the concept of financial education. Kiyosaki contrasts the financial philosophies of his “poor dad” (his biological father) and his “rich dad” (the father of his childhood friend), offering readers profound lessons about assets, liabilities, and the mindset required to build lasting wealth.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Drs. Stanley and Danko’s “The Millionaire Next Door” provides a fascinating exploration of the habits and characteristics of America’s wealthy individuals. Through meticulous research, the authors reveal that many millionaires lead frugal lives and prioritize savings and investments.

This eye-opening book challenges common perceptions about wealth and offers practical advice on accumulating and preserving financial resources.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

Originally published in the 1990s and revised for contemporary readers, “Your Money or Your Life” by Vicki Robin and Joe Dominguez is a holistic guide to transforming your relationship with money.

The book emphasizes the importance of aligning your spending with your values, understanding the true cost of your time, and achieving financial independence through mindful living. The nine-step program outlined in the book has helped countless individuals gain control of their finances and live more fulfilling lives.

“The Total Money Makeover” by Dave Ramsey

Dave Ramsey is a well-known figure in the world of personal finance, and “The Total Money Makeover” is one of his most influential works. Ramsey provides a step-by-step plan for getting out of debt, building an emergency fund, and investing for the future.

With a no-nonsense approach and a focus on personal responsibility, Ramsey’s book has helped many individuals take control of their financial destinies.

“The Intelligent Investor” by Benjamin Graham

Often referred to as the “bible of investing,” “The Intelligent Investor” by Benjamin Graham is a timeless masterpiece that has influenced generations of investors, including Warren Buffett.

Graham’s principles of value investing and his emphasis on a rational, disciplined approach to the stock market remain relevant today. This book is a must-read for anyone seeking a solid foundation in investment philosophy.

“Broke Millennial” by Erin Lowry

Targeted at younger generations, particularly millennials, “Broke Millennial” by Erin Lowry addresses the unique financial challenges faced by this demographic. Lowry combines personal anecdotes with practical advice on budgeting, investing, and navigating the complexities of student loans.

The book is written in a relatable and accessible style, making it an excellent choice for those new to personal finance.

“The Richest Man in Babylon” by George S. Clason

Written in the form of parables set in ancient Babylon, George S. Clason’s “The Richest Man in Babylon” imparts timeless financial wisdom. The book covers essential principles such as living below your means, investing wisely, and seeking sound financial advice. Despite its historical setting, the lessons in this book are as relevant today as they were when first published in the 1920s.

Conclusion

The journey to financial success is a personal and often challenging one, but these books serve as invaluable guides, offering insights, strategies, and timeless principles to empower individuals on their path to prosperity.

Whether you’re just starting your financial journey or looking to enhance your existing knowledge, these personal finance books provide a solid foundation and the inspiration needed to unlock your financial potential. By incorporating the lessons from these books into your life, you can build a secure financial future and make informed decisions that align with your long-term goals.

Frequently Asked Questions

“Rich Dad Poor Dad” challenges traditional notions of wealth and provides invaluable lessons on financial education, asset-building, and cultivating a wealth-oriented mindset.

The book offers insights into the habits of millionaires, revealing that many prioritize frugality, savings, and investments, challenging common stereotypes about the wealthy.

The book encourages readers to align their spending with their values, understand the true cost of their time, and work towards financial independence through mindful living.

Ramsey’s book provides a practical, step-by-step plan for individuals to eliminate debt, build emergency funds, and invest wisely, emphasizing personal responsibility and financial discipline.

Graham’s principles of value investing and disciplined market approaches, outlined in the book, have been fundamental to the strategies of successful investors, including Warren Buffett.

Erin Lowry addresses the financial challenges faced by millennials, making “Broke Millennial” an excellent resource for younger individuals seeking practical advice on budgeting, investing, and navigating student loans.

Despite its ancient Babylonian setting, the book imparts timeless financial wisdom, emphasizing principles such as living below your means, wise investing, and seeking sound financial advice.

These books provide foundational knowledge, practical strategies, and inspiration to empower individuals, offering a roadmap for making informed financial decisions and building a secure future.

The recommended books cater to a broad audience, from beginners to experienced investors, offering insights and principles that remain relevant regardless of one’s level of financial expertise.

By integrating the lessons from these books into daily life, individuals can develop a solid financial foundation, make informed decisions, and work towards achieving long-term financial goals, ultimately unlocking their financial potential.

With years of experience in personal finance, Lina is dedicated to providing practical insights and guidance. Her expertise includes budgeting, investing, and next-gen financial strategies.

Leave a Reply