Introduction:

In the constantly evolving financial landscape of 2024, the art of budgeting has become synonymous with financial empowerment. This article serves as a comprehensive guide, exploring avant-garde strategies that not only dissect emerging trends but also introduce innovative concepts to revolutionize personal finance. As we navigate this dynamic terrain, let’s delve into cutting-edge budgeting methodologies empowering individuals to sculpt their financial destinies amid constant change.

AI-Powered Budgeting Apps: Navigating the Future of Finance

The Rise of Artificial Intelligence in Finance

The impact of artificial intelligence (AI) on finance is monumental. In 2024, AI-powered budgeting apps emerge as sophisticated tools, evolving from mere expense trackers to intuitive financial companions.

Personalized Insights and Predictive Analytics: A Deep Dive

These apps delve into users’ financial behaviors, offering personalized insights and predictive analytics. The adaptability of these apps continuously refines recommendations based on evolving spending patterns, essentially becoming virtual financial mentors.

AI Beyond Numbers: The Human Touch

Going beyond traditional budgeting, these platforms incorporate machine learning algorithms, mirroring cognitive processes once reserved for financial experts. Witness the democratization of financial guidance as AI evolves into a virtual financial mentor.

The Future Horizon: Quantum Computing in Financial Decisions

Explore the cutting-edge possibilities of quantum computing in financial decisions. Understand how this technology may revolutionize AI-powered budgeting apps, providing unprecedented speed and accuracy in predicting financial trends.

Voice-Activated Financial Assistance

Dive into the rise of voice-activated financial assistants integrated into AI-powered budgeting apps. Explore how individuals can now manage their finances hands-free, leveraging natural language processing for seamless interactions.

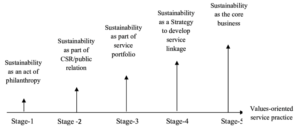

Sustainable Finance Integration: Merging Ethical Values with Fiscal Goals

The Convergence of Financial Responsibility and Environmental Stewardship

In 2024, financial responsibility intertwines with sustainability. Witness the rise of sustainable finance, where individuals align their fiscal goals with environmental, social, and governance (ESG) criteria.

Beyond Profit: Investing in a Greener Tomorrow

Explore the concept of sustainable investing and eco-friendly spending. Investing in environmentally conscious ventures is not just an ethical choice but a strategic one, fostering a robust financial portfolio while contributing to a sustainable future.

The Role of Green Bonds and ESG Investments

Delve into the specifics of sustainable finance instruments such as green bonds and ESG investments. Understand how these financial tools contribute to both environmental well-being and financial growth.

Impact Investing: Aligning Profits with Positive Change

Explore the rising trend of impact investing, where financial decisions go beyond profits to create positive societal and environmental impacts. Understand how aligning investments with personal values can redefine success in the financial realm.

Sustainable Banking Practices

Examine the emergence of sustainable banking practices. Explore how financial institutions are incorporating sustainability into their core operations, offering eco-friendly banking options and fostering responsible financial behavior.

Subscription-Based Budgeting: Rethinking Financial Planning for the Modern Era

Monthly Budgeting 2.0: Subscription-Based Models

Traditional monthly budgeting undergoes a paradigm shift with subscription-based models. Delve into the mechanics of allocating fixed funds to financial goals, akin to managing a suite of subscriptions, adding simplicity and adaptability to financial planning.

Adapting to Life’s Flux: The Strength of Subscription-Based Budgeting

Explore how this innovative approach adapts seamlessly to life’s changing circumstances. With a structured yet flexible framework, individuals gain an adaptable blueprint for financial goals, making prioritization and achievement more attainable.

The Rise of Financial Wellness Subscriptions

Discover the emerging trend of financial wellness subscriptions. Explore how these services go beyond traditional budgeting, offering comprehensive financial advice, investment insights, and even mental health support.

Gamification in Budgeting: Making Financial Management Engaging

Delve into the gamification of budgeting. Explore how incorporating game-like elements into financial apps and platforms can make the budgeting process more engaging and enjoyable, fostering better financial habits.

Personalized Learning Paths for Financial Literacy

Uncover the integration of personalized learning paths within subscription-based budgeting models. Explore how these paths enhance financial literacy, providing tailored educational content to empower individuals in their financial journey.

Behavioral Economics in Budgeting: Decoding the Psychology of Financial Decisions

Unraveling Financial Biases: The Essence of Behavioral Economics

In 2024, understanding the psychology behind financial decisions is paramount. Delve into how behavioral economics principles unravel financial biases, empowering individuals to make decisions that align with their long-term goals.

Empowering Choices: From Impulse to Informed Decision-Making

Recognize cognitive biases such as loss aversion and present bias. The essence lies not in manipulating behavior but in empowering individuals to make choices reflective of their values and aspirations.

The Role of Nudges in Financial Decision-Making

Explore the concept of nudges in behavioral economics. Understand how subtle interventions can positively influence financial decision-making, creating a pathway towards more informed choices.

Emotional Intelligence in Financial Management

Delve into the importance of emotional intelligence in financial management. Explore how understanding and managing emotions related to money can lead to better financial decisions and long-term wealth.

Neurofinance: Unveiling the Brain’s Role in Financial Choices

Examine the emerging field of neurofinance, which studies how the brain influences financial decisions. Explore the neurological aspects of decision-making and their implications for effective budgeting.

Collaborative Budgeting Platforms: A Symphony of Financial Transparency and Unity

Interconnected Finances: The Role of Collaborative Platforms

In the era of interconnectedness, collaborative budgeting platforms emerge as indispensable tools for managing finances collectively. Explore their functionality in setting financial goals, tracking expenses, and facilitating joint financial decisions.

Strengthening Bonds: The Power of Shared Financial Goals

Realize how these platforms contribute to stronger relationships by providing real-time updates and shared insights. In navigating financial challenges together, individuals foster unity and shared financial objectives.

The Future of Open Banking and Financial Collaboration

Look ahead to the future of open banking and financial collaboration. Explore how interconnected financial systems and data sharing can enhance collaborative budgeting, offering a more holistic view of individual and shared financial health.

The Evolution of Blockchain in Collaborative Finance

Explore the role of blockchain technology in collaborative finance. Understand how blockchain enhances security, transparency, and trust in collaborative financial platforms, paving the way for a decentralized and secure financial ecosystem.

Cross-Border Financial Collaboration: Navigating Global Finances Together

Investigate the trend of cross-border financial collaboration within collaborative platforms. Explore how individuals globally are joining forces to manage finances collectively, transcending geographical boundaries.

Conclusion:

As we navigate the complexities of 2024, the revolution in personal finance is marked by innovative and dynamic budgeting strategies. Embracing AI-powered apps, integrating cryptocurrencies, adopting sustainable finance practices, exploring subscription-based models, understanding behavioral economics, and leveraging collaborative platforms are pivotal steps toward financial success.

In this era of rapid technological advancement and interconnected global economies, staying informed and adapting

to emerging trends is non-negotiable. The revolution in financial strategies transcends mere money management; it’s about sculpting a secure, sustainable, and prosperous future. By embracing these trendsetting budgeting strategies, individuals confidently take charge of their financial destinies, navigating the ever-evolving landscape of personal finance with resilience and foresight. The fiscal horizon of 2024 is not merely a challenge but an opportunity for financial empowerment and transformation.

Frequently Asked Questions:

Q1: What makes AI-powered budgeting apps different from traditional budgeting methods?

Q2: How can I integrate cryptocurrencies into my budgeting strategy?

Q3: What is sustainable finance, and how can I incorporate it into my budget?

Q4: How does subscription-based budgeting differ from traditional monthly budgeting?

Q5: Can you provide an example of behavioral economics in budgeting?

Q6: How do collaborative budgeting platforms enhance financial transparency?

Q7: How can I stay informed about the latest trends in personal finance?

With years of experience in personal finance, Lina is dedicated to providing practical insights and guidance. Her expertise includes budgeting, investing, and next-gen financial strategies.

Leave a Reply